Cryptocurrencies have taken the financial world by storm, and Ethereum, with its robust technology and wide-ranging applications, has emerged as one of the leading players in the market. If you’re looking to venture into the exciting world of cryptocurrency trading, specifically Ethereum, it’s crucial to equip yourself with the necessary knowledge and confidence to navigate this dynamic landscape.

We explore the key steps to begin trading Ethereum with confidence, covering everything from setting up a cryptocurrency exchange account with a platform like ethereum-code.me, to understanding market orders, limit orders, and stop orders. So let’s dive in and discover the path to becoming a successful Ethereum trader.

In This Post

Choosing the Right Wallet

Choosing the right wallet is another critical aspect of trading with confidence. A wallet is where you store your ETH balance securely. There are various types of wallets available, each with its own advantages and considerations. Hardware wallets, such as Ledger and Trezor, offer offline storage and robust security features, making them an excellent choice for long-term holdings.

Software wallets, such as MetaMask and MyEtherWallet, provide convenient access and are suitable for frequent trading. Additionally, mobile wallets like Trust Wallet and Exodus offer a balance between security and accessibility. It’s important to research and select a wallet that aligns with your trading needs, taking into account factors such as security, user-friendliness, and compatibility with your devices.

Securing Your Holdings

Securing your Ethereum holdings is of utmost importance in the world of cryptocurrency trades. As a decentralized digital asset, Ethereum offers control and ownership directly to its users. However, this also means that the responsibility for securing your funds lies entirely with you. Implementing robust security measures is essential to protect your Ethereum from potential threats, such as hacking or phishing attempts.

Start by enabling two-factor authentication on your exchange account and wallet. Regularly update your passwords and ensure they are strong and unique. Consider using a password manager for added convenience and security. Furthermore, consider storing a backup of your wallet’s recovery phrase or private key in a safe and offline location. By following these security practices, you can trade Ethereum with confidence, knowing that your assets are well protected.

Fundamental Analysis: Evaluating ETH’s Potential

Fundamental analysis plays a crucial role in evaluating ETH’s potential as an investment. Understanding the underlying factors that can influence the price and value is essential for making informed trading decisions. When conducting fundamental analysis, consider factors such as Ethereum’s technology, scalability, adoption rate, developer activity, and partnerships.

Evaluate the use cases and potential impact of ETH in various industries, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts. Stay updated with news, research reports, and industry trends to gain insights into Ethereum’s future prospects. By conducting thorough fundamental analysis, you can develop a comprehensive understanding of the crypto’s value proposition and make informed trading decisions based on its potential for growth and adoption.

Technical Analysis: Analyzing Price Charts

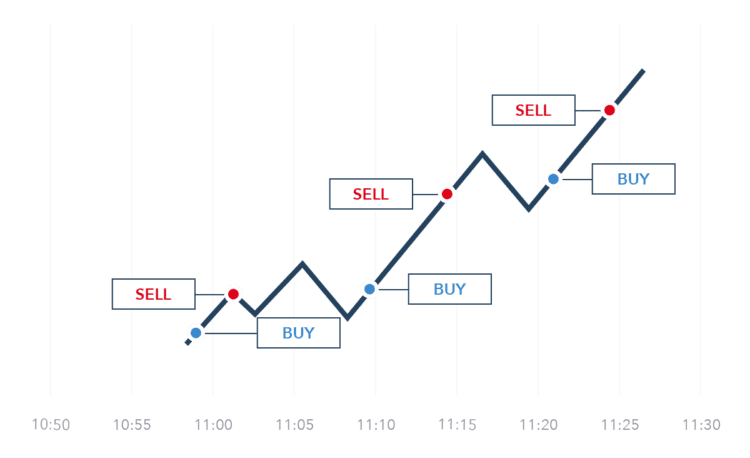

Technical analysis is a powerful tool for analyzing Ethereum price charts and identifying patterns and trends. By studying historical price data and applying various indicators and charting techniques, you can gain insights into market sentiment and potential price movements. Technical analysis helps traders identify entry and exit points, determine support and resistance levels, and anticipate trend reversals.

Common technical analysis tools include moving averages, relative strength index (RSI), MACD, and Fibonacci retracement levels. However, it’s important to note that technical analysis is not foolproof and should be used in conjunction with other forms of analysis. Developing proficiency in technical analysis requires practice, observation, and continuous learning. By mastering this skill, you can enhance your trading confidence and make more informed decisions based on Ethereum’s price charts.

Developing a Strategy

A strong strategy is a key component of trading Ethereum with confidence. It outlines your approach, goals, risk tolerance, and the rules you’ll follow when executing trades. A well-defined strategy helps you stay disciplined, manage emotions, and reduce impulsive decision-making. Start by defining your goals and objectives. Determine your risk tolerance and the amount of capital you’re willing to allocate.

Decide on the type of trading you’ll engage in, such as day, swing, or long-term. Establish entry and exit criteria based on your analysis and risk management principles. It’s crucial to backtest your strategy using historical data to assess its effectiveness before implementing it with real funds. Remember, a trading strategy should be flexible and adaptable to changing market conditions, allowing you to adjust your approach as needed.

Managing the Risks

Managing risk is an essential aspect of trading Ethereum with confidence. Cryptocurrency markets can be highly volatile, and it’s crucial to protect your capital from significant losses. Risk management involves implementing strategies to minimize potential losses and protect profits. One commonly used risk management technique is setting a stop-loss order, which automatically sells your Ethereum if the price reaches a predetermined level, limiting your potential losses.

It’s important to determine an appropriate stop-loss level based on your risk tolerance and the market’s volatility. Additionally, consider diversifying your cryptocurrency portfolio to spread the risk across different assets. Never invest more than you can afford to lose, and avoid making impulsive decisions based on market hype or fear. By implementing effective risk management techniques, you can trade ETH with confidence, knowing that you have measures in place to mitigate potential losses.

Starting Small: Initial Investments and Position Sizing

Starting small and gradually increasing your investments is a prudent approach when beginning your Ethereum trading journey. It’s advisable to start with a smaller portion of your capital and gradually increase your position as you gain experience and confidence in your abilities. This allows you to learn from your trades, adapt your strategy, and manage potential losses without risking a substantial amount of capital upfront.

Starting small also helps you familiarize yourself with the trading platform, order types, and market dynamics. Consider using a demo account or paper trades to practice your strategies and gain confidence before trading with real funds. As you gain experience and achieve consistent profitability, you can incrementally increase your investments and position sizes, aligning with your risk management principles.

Placing Trades: Market Orders, Limit Orders, and Stop Orders

Placing trades effectively is a critical skill for trading Ethereum with confidence. Understanding different types of orders and when to use them is key to executing trades successfully. Market orders are executed at the current market price and offer fast execution, while limit orders allow you to set a specific price at which you want to buy or sell Ethereum.

Stop orders are used to trigger a market order when the price reaches a certain level, allowing you to limit losses or secure profits. It’s important to familiarize yourself with the order placement process on your chosen cryptocurrency exchange and understand the fees associated with different order types. Practice placing trades and monitoring their execution to ensure a smooth and accurate trading experience.

Summary

ETH trading can be a great way to increase your financial portfolio and grow your savings. With the right strategies in place, you can confidently take the leap into trading Ethereum. Start by doing research on the current market trends and understanding what works for you. Then use powerful tools like blockchain technology and cryptocurrency exchanges to complete secure transactions without any disruption or delays. Finally, don’t forget to diversify your investments and always keep a watchful eye on the ever-changing markets. By following these steps, you will be well-prepared to start trading Ethereum with confidence!